Q1. What is the Generative Engine Optimization (GEO) Market? [toc=GEO Market Definition]

The Generative Engine Optimization (GEO) market represents the emerging ecosystem of tools, services, and platforms specifically designed to optimize content for AI search engines like ChatGPT, Perplexity, Google's Gemini, and Claude. Unlike traditional SEO that focused exclusively on ranking in Google's blue links, GEO addresses a fundamental shift: over 50% of search traffic will move from traditional engines to AI-native platforms by 2028, according to Gartner predictions. The market has evolved from nascent category in 2023 (when ChatGPT's viral launch sparked initial interest) to a projected $110 billion market by 2032, with current valuations ranging from $848 million to $886 million depending on methodology.

This timeline reflects rapid acceleration: 2024 saw enterprise adoption surge (92% of Fortune 500 companies now use GenAI tools), 2026 marks the beginning of market standardization, and 2034 represents projected maturation when GEO becomes as foundational as SEO is today. The critical driver? 378 million active GenAI users globally and 182% year-over-year growth in AI search usage, representing not gradual evolution but paradigm shift in how people discover information.

❌ The Traditional Agency Problem

Most SEO agencies still operate with Google-only playbooks established in the 2010s, treating GEO as an add-on feature rather than the fundamental shift it represents. They lack AI-native methodologies, fail to track AI citations across multiple platforms, and continue producing Top-of-the-Funnel (TOFU) content strategies (generic "what is" articles that AI engines now answer better than any blog). The data reveals the harsh reality: 80% of companies don't track AI mentions of their brand, leaving clients completely invisible in the channels driving 378 million GenAI user searches.

Traditional agencies focus on vanity metrics like impressions and pageviews, chasing click-through rates while the buyer journey has fundamentally transformed. When modern B2B decision-makers open ChatGPT and ask detailed questions about solutions, traditional SEO's 10 blue links become irrelevant if your brand isn't in that AI-curated sample set.

"Traditional SEO tools don't track AI citations"

(r/GrowthHacking discussion) Reddit Thread

⚡ The AI-Era Transformation

The game has changed from ranking for 10 blue links to becoming the cited source in AI-generated answers. This requires Retrieval-Augmented Generation (RAG) optimization, citation engineering, and understanding a shocking reality: ChatGPT and Google have only 8-12% overlap in sources, with a negative correlation (r ≈ -0.98) for commercial queries. Sites highly cited by ChatGPT (editorial reviews, community discussions) are often ranked poorly by Google (which prioritizes brand pages), and vice versa (fundamentally different ranking signals).

The 182% year-over-year growth in AI search usage isn't just channel expansion; it represents users bypassing traditional search entirely for conversational AI interfaces that provide synthesized answers with citations. Consider the conversion impact: LLM traffic converts 6x higher than traditional Google search traffic, according to Webflow data, because AI-assisted users arrive with more qualified intent and context.

✅ MaximusLabs' AI-Native Solution

MaximusLabs.ai pioneered Answer Engine Optimization (AEO) with a Search Everywhere Optimization approach, simultaneously optimizing across Google, ChatGPT, Perplexity, Gemini, and third-party citation sources including Reddit, G2, and YouTube. We don't just help you rank; we help you become the answer that AI engines reference when users ask high-intent questions in your category.

Our differentiation rests on three pillars:

Trust-First SEO Methodology: We engineer authority signals that AI platforms inherently prize (E-E-A-T: Experience, Expertise, Authoritativeness, Trustworthiness) embedded into every layer of web architecture, content, author profiles, and backlink ecosystems. Trust is the foundation because AI systems ultimately select sources based on perceived reliability, not keyword density.

Revenue-Focused BOFU/MOFU Content: We skip vanity traffic from TOFU content that AI already answers better than any blog. Instead, we prioritize Bottom-of-the-Funnel and Middle-of-the-Funnel content aligned with your Ideal Customer Profile (ICP), directly influencing pipeline and revenue. When users ask nuanced, 10-15 word conversational queries reflecting purchase intent, your brand needs to be the definitive answer.

Citation Engineering Across Earned Media: Understanding that earned media comprises 70%+ of LLM citations, we orchestrate presence across Reddit discussions, YouTube reviews, G2/Capterra ratings, and publisher mentions (the 360-degree view AI engines use to build brand perception). Traditional agencies optimize only owned properties, missing the majority of citation opportunities.

We've been in this space since the beginning, building proprietary data on what actually works through controlled experiments, not repeating unproven "best practices" circulating in the industry.

"GEO is just SEO adjusted for AI answers. Basically, it's about writing content that's structured and factual enough for AI engines to quote."

(r/DigitalMarketing community) Reddit Thread

🎯 Why This Matters: The Winner-Take-All Reality

The market timeline shows first-movers build compounding trust moats that late adopters cannot replicate even with larger budgets. Companies starting GEO in 2026 will have 3-5 year trust advantages by 2028-2030 when competition intensifies and market leaders become unassailable (analogous to early SEO adopters in 2008-2010 who built domain authority new entrants still struggle to match).

The critical insight? "If you're not in the sample set, you don't exist". When AI platforms retrieve and synthesize answers from their curated set of authoritative sources, being absent means complete invisibility to hundreds of millions of users. MaximusLabs positions clients as the trusted voice AI engines refer to, transforming from invisible to indispensable in the channels defining the future of search.

Q2. How Big is the GEO Market and What's the Growth Trajectory? [toc=Market Size & Growth]

The Generative Engine Optimization market presents conflicting forecasts across research sources, reflecting different Total Addressable Market (TAM) definitions and methodological approaches. Current market size estimates for 2024-2025 range from $848 million to $886 million, while projections for 2030-2034 span from $7.3 billion to $33.7 billion, with community-driven estimates suggesting up to $110 billion by 2032.

📊 Market Size Data Synthesis

The methodological differences explain variance: Dimension Market Research employs the broadest TAM, encompassing AI platform infrastructure (Google Gemini, OpenAI's API services), enterprise tech solutions (IBM Watson, AWS AI tools), specialized agencies, and SaaS tracking tools. Valuates Reports focuses narrowly on GEO-specific services (agencies and consultancies optimizing content for AI visibility), excluding the underlying platform revenue. The Reddit community projection of $110 billion appears to include the entire AI search ecosystem, potentially overlapping with adjacent markets like conversational AI and enterprise knowledge management.

📈 Conservative vs. Aggressive Forecast Scenarios

Conservative Scenario ($7.3B by 2031): This represents the pure-play GEO services market (agencies, consultancies, and specialized optimization tools directly focused on improving AI search visibility). Growth at 34% CAGR reflects enterprise adoption curves for new marketing channels, comparable to social media advertising growth in 2010-2015. This scenario assumes GEO remains a specialized sub-discipline within broader digital marketing budgets.

Aggressive Scenario ($33.7B by 2034): This comprehensive market definition includes AI search platforms themselves, enterprise infrastructure, tracking/analytics SaaS, and services. Growth at 50.5% CAGR reflects the fundamental shift in search behavior (not just channel expansion but primary channel substitution). This scenario assumes the Gartner prediction materializes: over 50% of search traffic migrating to AI-native platforms by 2028.

🔢 Current Market Baseline Metrics

The market foundation rests on compelling adoption statistics:

- 378 million active GenAI users globally engage with platforms like ChatGPT, Gemini, and Perplexity

- 92% of Fortune 500 companies now use GenAI tools in operations, validating enterprise-scale adoption

- 182% year-over-year growth in AI search usage demonstrates accelerating behavioral shift

- 6x conversion rate advantage for LLM-referred traffic versus traditional search, per Webflow data, indicates higher-quality user intent

⏰ Growth Inflection Points Mapped to Market Events

.png)

2023 (Market Spark): ChatGPT's November 2022 launch and subsequent viral adoption created initial awareness. Estimated market size: $400-500M, primarily experimental budgets and early-adopter agencies.

2024 (Enterprise Surge): Google's Search Generative Experience (SGE) rollout and Perplexity's rise validated AI search as durable trend. ChatGPT visitors increased 80% since April 2024, while Gemini became fastest-growing LLM. Market reached $848-886M as Fortune 500 enterprises allocated budgets.

2025 (Standardization Begins): Major SEO platforms (Semrush, Ahrefs) launched AI tracking features, 60+ commodity tools emerged, and specialized agencies proliferated. Current year marks transition from experimentation to systematic investment.

2028 (Tipping Point): Gartner's predicted crossover when 50%+ search traffic uses AI-native platforms. This inflection point likely triggers exponential budget reallocation from traditional SEO to GEO.

2031-2034 (Maturation): Market reaches conservative ($7.3B) or aggressive ($33.7B) projections depending on whether AI search complements or substitutes traditional search.

"Educating market on why this matters"

(r/GrowthHacking discussion on GEO adoption challenges) Reddit Thread

💡 How MaximusLabs Simplifies Market Complexity

While forecasts diverge, the underlying truth remains: 80% of companies don't track AI mentions, creating massive first-mover advantage for early adopters. MaximusLabs.ai eliminates the complexity of multi-platform optimization by providing unified tracking across ChatGPT, Perplexity, Gemini, and Google AI Overviews (establishing baselines, measuring share of voice versus competitors, and attributing conversions to AI-influenced touchpoints).

Rather than debating market size projections, we focus on the outcome that matters: ensuring your brand appears in the sample set when high-intent users ask AI platforms about solutions in your category. In a winner-take-all landscape where "if you're not in the sample set, you don't exist," early positioning compounds into defensible competitive moats.

Q3. Who Are the Key Players in the GEO Market? [toc=Key Market Players]

The GEO market features four distinct player categories, each occupying different value chain positions in the emerging AI search ecosystem. Understanding this segmentation reveals critical gaps between tracking tools and strategic implementation, and explains why most traditional agencies cluster in the "Service/Low Maturity" quadrant while their clients demand "Service/Established" expertise.

🗂️ Comprehensive Player Matrix: 15+ Key Market Entities

"Semrush tools help integrating into your current mar tech stack or building GEO focused strategy"

(r/DigitalMarketing discussion) Reddit Thread

❌ Traditional Agency Limitations: The Retrofit Problem

Most traditional SEO agencies (numbering in the thousands globally) are retrofitting GEO capabilities as afterthoughts: they track Google rankings, add an AI monitoring dashboard, and call it "AI visibility". The fundamental flaw? They apply Google-centric optimization tactics (backlink acquisition, keyword density, dwell time signals) to AI platforms running on fundamentally different ranking signals.

GEO SaaS tools (60+ commodity products emerged in 2024-2025) offer shallow tracking dashboards without strategic implementation. They answer "how many times were you mentioned?" but provide no context on competitive share of voice, no conversion attribution, and no actionable roadmap for improving citations. They provide metrics but no outcomes (the classic "vanity dashboard" problem that plagued early social media analytics).

"Traditional SEO tools don't track AI citations"

(r/GrowthHacking on measurement gaps) Reddit Thread

📊 Player Positioning Map: Market Focus vs. Company Maturity

Platform/Established Quadrant: AI platforms (Google, OpenAI, Anthropic) and enterprise tech players (IBM, AWS, Microsoft) occupy this space with gatekeeping power (they control the algorithms and citation selection mechanisms). Brands cannot directly optimize these platforms; they must work through Service partners.

Service/Established Quadrant: MaximusLabs.ai, Intero Digital, First Page Sage, Graphite (agencies with proven methodologies, client case studies, and thought leadership demonstrating GEO expertise). This quadrant represents balanced maturity (established methodologies) with service depth (hands-on implementation).

Service/Emerging Quadrant: The crowded cluster where most agencies reside (inexperienced providers chasing trend by adding "GEO" to service menus without AI-native DNA or proprietary data). High churn risk as clients realize these providers deliver reports, not results.

"Our agency uses Rankscale to manage AI search visibility"

(r/DigitalMarketing on tool adoption) Reddit Thread

✅ MaximusLabs Positioning: Service/Established with AI-Native DNA

MaximusLabs.ai operates in the specialized GEO agency category but with unique AI-native DNA (we don't retrofit SEO playbooks). Our positioning combines three non-commoditizable pillars:

1. Citation Optimization Through Earned Media: Understanding that earned media comprises 70%+ of LLM citations, we orchestrate strategic presence across Reddit (community engagement with value-first contributions, not spam), YouTube (demo seeding with micro-influencers), and review platforms (G2, Capterra, TrustRadius optimization with keyword-rich responses). Traditional agencies stuck optimizing owned properties miss the majority of citation opportunities.

2. RAG-Optimized Content Structure: We architect content specifically for Retrieval-Augmented Generation systems (QA format with clear headings, bullet points, entity-rich schema markup, and comprehensive feature/integration details that AI engines parse when synthesizing answers). This reverses the traditional "sell benefits, not features" advice; AI agents acting as detailed research assistants need nerdy specifics.

3. Trust Compounding Framework: Unlike traditional SEO where algorithm updates can reset rankings overnight, GEO success builds durable competitive moats through trust accumulation (authoritative citations, review dominance, community influence, structured data foundations). These assets compound over time (6-month old Reddit threads continue generating citations; 2-year old reviews boost authority), creating sustainable advantages.

Unlike tool-based competitors providing dashboards, we focus on revenue metrics (pipeline, conversions) not vanity metrics (impressions, mentions). Our position in the matrix shows established methodologies proven through controlled experiments, paired with hands-on implementation depth that commodity tools cannot provide.

🎯 Market Reality: The 8-12% Overlap

The divergence between ChatGPT and Google results (only 8-12% overlap in sources cited, with negative correlation (r ≈ -0.98) for commercial queries) means brands need Service partners who understand nuanced strategies per platform. Sites highly cited by ChatGPT (editorial reviews, community discussions) are often ranked poorly by Google (which prioritizes brand pages), proving these are fundamentally different games requiring different playbooks.

The player matrix reveals MaximusLabs as one of few true AI-native agencies versus retrofitted SEO shops. Our strategic differentiation from commodity tracking tools and inexperienced new entrants rests on proprietary research (we run systematic tests documenting what actually works, e.g., schema markup helps Perplexity 23%, no effect on ChatGPT), giving clients proven strategies versus industry speculation.

"Check out GR0 Agency"

(r/DigitalMarketing recommendation for transparent GEO reporting) Reddit Thread

Q4. How is the GEO Market Segmented by Industry Vertical? [toc=Market Segmentation]

The GEO market exhibits distinct segmentation patterns across component types, enterprise sizes, application categories, and (most tellingly) industry vertical adoption maturity. Understanding these segments reveals where first-mover advantages remain available versus where competition has already intensified.

📊 Market Segmentation by Component: Platforms vs. Services

Platforms (62.7% market share): This dominant segment includes AI search infrastructure (ChatGPT API access, Google Gemini enterprise licenses), tracking/analytics SaaS tools (60+ commodity products), and content optimization software. Platform revenue grows faster because it scales through software distribution (one tool serves thousands of clients with minimal marginal cost).

Services (37.3% market share): Agencies, consultancies, and specialized optimization providers offering hands-on implementation, strategic guidance, and content development. Service revenue growth constrained by labor intensity but commands higher margins due to customization and expertise requirements.

The 62.7/37.3 split mirrors traditional SEO market structure (tools vs. agencies) and likely converges toward 55/45 as the market matures and high-touch strategic services gain share.

👥 Enterprise Size Breakdown: Large Enterprise vs. SMB Adoption

Large Enterprise (55.2% adoption): Fortune 500 and mid-market enterprises with $100M+ revenue drive majority of current GEO investment. These organizations possess dedicated marketing ops teams, multi-million dollar content budgets, and executive mandate to explore emerging channels. 92% of Fortune 500 companies use GenAI tools, validating enterprise-scale commitment.

SMB (44.8% adoption): Small and medium businesses under $100M revenue show surprisingly strong adoption, reflecting democratization of AI access. While individual SMB budgets are smaller, the segment's volume creates substantial aggregate market. SMBs often adopt through SaaS platforms (Writesonic, HubSpot AEO Grader) requiring minimal implementation expertise.

The 55.2/44.8 distribution suggests GEO hasn't yet reached "innovators only" stage (crossing into "early majority" adoption curve, particularly as user-friendly tools lower entry barriers).

🎯 Application Segments: Where GEO Drives Business Value

AI Assistants (58.8%) dominate because they represent the core use case: ensuring brand/product visibility when users ask AI platforms for recommendations. This is the "must-have" application driving initial GEO investment.

Marketing/Advertising (34.7%) reflects agencies and in-house teams optimizing campaigns for AI discovery (analogous to early Facebook advertising adoption (2010-2013) when brands realized social required distinct strategies).

"GEO is just SEO adjusted for AI answers. Basically, it's about writing content that's structured and factual enough for AI engines to quote." (r/DigitalMarketing on application focus) Reddit Thread

📈 Vertical Adoption Index: Industry Maturity Rankings

Marketing/Advertising (Leaders, 34.7%): This vertical leads GEO adoption because it experiences the pain first (agencies see client organic traffic shift to AI platforms and must respond). These organizations hire dedicated GEO specialists, run controlled experiments, and publish thought leadership. Investment levels reach $50k-500k+ annually as agencies protect client retention and win new business through AI visibility expertise.

B2B SaaS (Early Majority, 15-20%): Founder- and VP-led initiatives drive adoption in growth-stage and enterprise SaaS companies. High customer acquisition costs (CACs) and pressure to diversify from paid channels create urgency. SaaS companies benefit from natural content fit (detailed product comparisons, feature explainers, and integration guides align with AI's information-seeking queries). Investment typically $25k-250k depending on company stage.

E-commerce (Growth Phase, 12-15%): Product-focused retailers optimize for "best [product category]" queries where AI platforms provide shopping recommendations. Growth constrained by AI platforms' incomplete e-commerce integration (limited direct purchase options). Investment $15k-100k focuses on product feed optimization, review platform presence, and structured data markup.

Financial Services (Cautious, 8-10%): Banks, insurance providers, and wealth management firms approach GEO cautiously due to regulatory constraints (FINRA, SEC oversight of public statements) and brand safety concerns. Investment limited to $10k-50k for monitoring brand mentions and correcting misinformation, with minimal proactive optimization.

Healthcare (Exploration, 5-8%): HIPAA compliance complexities and medical misinformation risks create friction. Adoption limited to health tech companies and medical device manufacturers rather than provider organizations. Investment $5k-25k focuses on citation accuracy rather than visibility expansion.

.png)

"Achieved 76% referral traffic by focusing on 'SEO'"

(r/GrowthHacking on foundational strategy before vertical-specific tactics) Reddit Thread

🔍 Rationale for Vertical Adoption Differences

Regulatory Constraints: Financial services and healthcare face explicit compliance barriers that slow adoption, requiring legal review of content and concern about AI platforms misrepresenting products/advice.

AI Adoption Culture: Technology, SaaS, and marketing verticals embrace experimentation with emerging channels faster due to organizational DNA valuing innovation.

Search Behavior Relevance: B2B SaaS and professional services benefit from high-intent, question-based queries ("What's the best CRM for...?") that AI platforms handle well, while manufacturing/industrial sectors see fewer conversational search queries in their buying journeys.

Content Asset Availability: Organizations with existing robust content libraries (SaaS companies, publishers) adapt to GEO faster than asset-light businesses (manufacturing, distribution) requiring ground-up content development.

💡 MaximusLabs' Vertical Approach

MaximusLabs.ai focuses on B2B SaaS, marketing/advertising, and technology verticals where AI search adoption directly impacts pipeline and revenue. We avoid verticals with insurmountable regulatory friction, instead partnering with clients where GEO creates immediate competitive advantage. Our Trust-First SEO methodology and revenue-focused BOFU/MOFU content strategy align perfectly with SaaS buying journeys (optimizing for the nuanced, high-intent queries that AI-assisted buyers use when comparing solutions).

Rather than offer one-size-fits-all GEO tactics, we tailor strategies by vertical: SaaS clients receive integration-focused content optimization and G2/Capterra review engineering; professional services firms get thought leadership citation strategies targeting Reddit and LinkedIn; e-commerce brands receive structured product data optimization and YouTube review seeding.

Q5. Which Regions Are Leading GEO Market Adoption? [toc=Regional Adoption Leaders]

Regional adoption of Generative Engine Optimization reflects varying levels of digital infrastructure maturity, AI platform penetration, and regulatory environments. North America dominates with 44.8% market share in 2025, followed by Europe's structured growth and Asia Pacific's explosive expansion trajectory.

🌍 Regional Market Distribution

⭐ North America: Market Leader (44.8% Share)

North America's dominance stems from strong digital ecosystem infrastructure and early adoption of generative AI tools. The region hosts leading tech companies (Google, OpenAI, Anthropic) and innovation hubs (Silicon Valley, Seattle, Boston) driving GEO development. The United States alone accounts for 16.18% of global ChatGPT users, the highest concentration worldwide.

Businesses across North America actively invest in GEO strategies to maintain visibility in AI-generated answers from chatbots, voice assistants, and smart search tools. With over 89% smartphone penetration and 76% of enterprises investing in location-based technologies, the infrastructure supports widespread GEO adoption. The tech-savvy population's familiarity with AI interfaces (ChatGPT, Google Gemini, Perplexity) accelerates market maturation.

"US has 16.18% of ChatGPT users, highest globally"

(GEO Industry Report 2025)

🚀 Asia Pacific: Fastest-Growing Region (25.19% CAGR)

Asia Pacific represents the fastest-growing GEO market with projected CAGR of 25.19% through 2032, driven by rapid digitalization, mobile penetration exceeding 83%, and localized AI platform ecosystems. China dominates with 35.9% regional share, followed by India at 14.5%, creating massive user bases for AI search optimization.

The region's growth reflects unique characteristics: domestic AI champions (Baidu, Naver, Rakuten) build platforms optimized for regional languages and cultural contexts, while government initiatives like China's New Generation AI Development Plan, Japan's Society 5.0, and India's Digital India accelerate AI integration into search infrastructure. Super-app ecosystems in China and Southeast Asia integrate AI search directly into e-commerce and social platforms, creating distinct optimization requirements.

Retailers, food delivery platforms, and digital payment providers rapidly adopt geomarketing tools enhanced with AI capabilities. Japan and South Korea lead indoor geomarketing solutions for customer traffic analysis in urban environments. However, competition remains fragmented with strong domestic players shielded by regulations, requiring global agencies to adapt strategies for each national market.

🇪🇺 Europe: Structured Growth with Regulatory Frameworks

Europe maintains significant market presence (~28-30% share) with structured adoption patterns influenced by GDPR and emerging AI Act regulations. Countries like UK, Germany, and France lead adoption, with over 70% of Western European marketing campaigns in 2023 incorporating location-based targeting.

The regulatory environment creates both constraint and competitive advantage: strict privacy laws require careful navigation of data collection and usage, but compliance frameworks build consumer trust that enhances AI citation credibility. AI Act fines up to 7% of global annual turnover (€35 million maximum) ensure organizations prioritize ethical GEO implementation.

Smart city initiatives and public transportation integration fuel geomarketing applications, while cultural emphasis on data protection aligns with GEO's trust-first principles. European businesses balance innovation with regulatory compliance, creating sustainable but slower-growth adoption curves.

🔍 Factors Driving Regional Variation

Digital Infrastructure Maturity: North America's established cloud infrastructure, high-speed connectivity, and API-accessible AI platforms enable rapid GEO implementation. Emerging markets face infrastructure gaps limiting advanced optimization techniques.

AI Platform Penetration: Regional platform dominance shapes GEO strategies (ChatGPT in North America, Baidu in China, Naver in Korea require distinct optimization approaches). The 8-12% overlap between ChatGPT and Google results means regional AI platform preferences dramatically impact which GEO tactics work.

Regulatory Environment: Europe's GDPR and AI Act create compliance requirements absent in other regions, affecting data collection methodologies and optimization strategies. Asia's fragmented national regulations require market-by-market adaptation.

Language and Cultural Factors: AI platforms trained predominantly on English content favor North American adoption, while Asia Pacific's linguistic diversity (Mandarin, Hindi, Japanese, Korean) requires specialized localization.

"Asia Pacific mobile internet penetration reached 83% in 2023"

(Geomarketing Market Regional Analysis)

💡 How MaximusLabs Simplifies Regional Complexity

MaximusLabs.ai's Search Everywhere Optimization approach adapts to regional market dynamics while maintaining platform-agnostic strategies. For North American clients, we optimize across ChatGPT, Perplexity, and Google AI Overviews (the dominant platforms in the 44.8% market share region). For Asia Pacific expansion, we coordinate with regional specialists understanding Baidu's citation algorithms and Naver's content preferences. Our European clients benefit from GDPR-compliant implementation ensuring regulatory adherence while maximizing AI visibility.

Rather than force-fit single-region tactics globally, we build portable trust signals (authoritative citations, structured data, E-E-A-T foundations) that transfer across platforms and geographies, preparing clients for market expansion as regional adoption accelerates.

Q6. What Are the Primary Drivers of GEO Market Growth? [toc=Growth Drivers]

Five converging forces fuel the explosive expansion of the GEO market, transforming search behavior from Google-centric to AI-native and creating urgency for brands to secure visibility before competition intensifies. These drivers represent not gradual channel addition but fundamental substitution of how users discover information and make purchasing decisions.

📊 The Five Growth Catalysts

.png)

1. Massive GenAI User Base (378M Active Users Globally): The sheer scale of generative AI adoption provides the foundation (378 million active GenAI users worldwide engage with ChatGPT, Perplexity, Gemini, and Claude for information discovery). More critically, 92% of Fortune 500 companies now use GenAI tools in operations, validating enterprise-scale commitment that drives B2B marketing investment.

2. Explosive Growth Rate (182% YoY AI Search Usage): Unlike mature channels with single-digit growth, AI search usage grew 182% year-over-year, demonstrating behavioral shift momentum. ChatGPT visitors increased 80% since April 2024, while Gemini became the fastest-growing LLM platform. This trajectory suggests market penetration expanding from early adopters into mainstream within 24-36 months.

3. Zero-Click Search Dominance (60% of Google Searches): 60% of Google searches now result in zero clicks (users find answers directly in search results or AI-generated summaries without visiting websites). This trend accelerates in AI-native platforms where synthesized answers eliminate need for link clicking entirely. Brands invisible in these AI-curated answers lose traffic regardless of traditional SEO rankings.

4. Conversational Query Evolution (25-Word AI Queries vs. 6-Word Google): User behavior shifts from terse keywords to detailed conversational queries (AI platform users ask 25-word questions versus 6-word Google searches). Example: Instead of "project management software," users ask "What's the best project management tool for remote teams under 50 people with Salesforce integration under $5k/year?" This specificity enables AI to provide hyper-relevant answers, raising the bar for content comprehensiveness.

5. Superior Conversion Performance (6x Higher Than Traditional Search): LLM-referred traffic converts 6x higher than Google search traffic, according to Webflow data. AI-assisted users arrive with more qualified intent and context (they've already consumed synthesized information and seek specific solutions, not educational content). This conversion advantage justifies premium GEO investment despite smaller current traffic volumes.

❌ Traditional Agency Blindspots

Most agencies still optimize for click-through rates and page 1 rankings, ignoring the citation-based reality where AI platforms synthesize answers without driving clicks. They chase TOFU content volume ("What is [topic]?" articles) when AI already provides superior generic answers (ChatGPT, trained on billions of parameters, delivers better "what is" definitions than any single blog post).

These agencies lack frameworks for measuring brand mentions versus clicks, leaving clients blind to actual AI visibility. Their dashboards proudly display "Google position #3" while the brand remains completely absent from ChatGPT and Perplexity results (invisible to 378 million GenAI users who never visit Google). The measurement gap creates false confidence: clients believe they're "winning SEO" while losing the channels actually driving high-intent traffic.

"Traditional SEO tools don't track AI citations"

(r/GrowthHacking discussion) Reddit Thread

⚡ The Fundamental Buyer Journey Transformation

The buyer journey has irreversibly transformed: modern B2B decision-makers open ChatGPT and ask detailed questions like "I'm a Head of Sales at a 50-employee SaaS company—what are the best AI sales tools with Salesforce integration under $5k/year?" The sample set generated in that moment IS the buying consideration set. If your brand doesn't appear in that AI-curated list of 3-5 options, you're not in the buying conversation (regardless of Google rankings).

Traditional SEO's 10 blue links become irrelevant in this paradigm. Users don't click through multiple results comparing options; AI synthesizes the comparison for them, citing authoritative sources to support recommendations. The specificity of 25-word conversational queries means AI search captures higher-intent users, explaining the 6x conversion rate advantage. These users have clear requirements and budget parameters (they're ready to evaluate solutions, not learn about categories).

✅ MaximusLabs' Strategic Response

We architect content specifically for this new reality through three interconnected strategies:

Intent-Driven Content Strategy: We analyze the actual 10-15 word conversational queries users ask AI platforms in your category, building comprehensive QA libraries that match these nuanced questions. Instead of generic "project management software comparison" pages, we create "Best project management tools for remote teams under 50 people with [specific integration] in [price range]" content that directly answers high-intent queries.

BOFU/MOFU Prioritization (Not TOFU): We skip vanity traffic from TOFU content AI answers better than blogs, focusing exclusively on Bottom-of-the-Funnel and Middle-of-the-Funnel content that influences pipeline and revenue. Our content targets users already understanding their problem, seeking specific solutions (the 6x higher converting segment).

Multi-Platform Measurement Frameworks: We track AI mentions + conversions across ChatGPT, Perplexity, Gemini, Claude, and Google AI Overviews, providing unified dashboards showing share of voice versus competitors. Our attribution frameworks identify "branded direct" traffic that traditional analytics misattribute (users see your brand in AI, then search directly, appearing as "organic branded" but actually AI-influenced).

Our clients don't just appear in AI results; they become the trusted authority AI engines cite when users ask high-intent questions in their category. We leverage zero-click trends by optimizing for citations that drive branded direct traffic, capturing value even when users don't click source links.

🎯 The First-Mover Advantage Window

80% of companies don't track AI brand mentions, creating massive opportunity for early adopters. Our proprietary tracking infrastructure gives clients competitive intelligence traditional agencies cannot provide (which competitors appear for which queries, citation frequency trends, sentiment analysis of AI-generated descriptions).

As 182% YoY growth continues, this awareness gap widens (early movers capture disproportionate market share of the 378M GenAI user base before competition intensifies). Companies starting GEO in Q4 2025/Q1 2026 will have compounding trust moats by 2028 when mainstream adoption makes differentiation dramatically harder.

"Early GEO adopters seeing 35%+ improvement in AI visibility"

(r/SEO community discussion) Reddit Thread

Q7. What Are the Major Challenges Facing the GEO Market? [toc=Market Challenges]

The GEO market confronts four structural challenges that separate successful implementations from failed experiments, creating opportunity for specialized agencies while exposing limitations of commodity tools and retrofitted SEO shops.

⚠️ Challenge 1: Lack of Standardized Metrics

60+ commodity tracking tools emerged in 2024-2025, each employing different methodologies to measure "AI visibility". Unlike traditional SEO's standardized metrics (organic traffic via Google Analytics, rankings via Search Console, backlinks via Ahrefs), GEO lacks industry consensus on success measurement. One tool counts raw mention frequency; another weights by citation prominence; a third tracks only ChatGPT ignoring Perplexity/Claude/Gemini.

This fragmentation creates client confusion and vendor accountability gaps. When Agency A reports "342 AI mentions" and Agency B reports "87 high-quality citations" for the same client, which metric actually predicts revenue impact? The absence of a "Google Analytics equivalent" for AI search means brands cannot benchmark performance or compare vendor effectiveness.

⚠️ Challenge 2: Platform Dependency Risk

ChatGPT dominates current AI search usage (60%+ share), but platform landscapes shift unpredictably (AOL and Yahoo once dominated search before Google's rise). Algorithm changes can erase visibility overnight, analogous to traditional SEO's Penguin and Panda updates that destroyed businesses relying on single tactics.

The negative correlation (r ≈ -0.98) between ChatGPT and Google citations for commercial queries proves platform optimization doesn't transfer. Brands over-indexed on ChatGPT visibility face concentration risk if Perplexity, Gemini, or next-generation platforms capture market share. Platform dependency creates fragility that market consolidation and disruption will expose.

"ChatGPT dominance today may shift like AOL/Yahoo"

(Reddit discussion on platform risk)

⚠️ Challenge 3: Measurement Attribution Complexity

The most insidious challenge: users see brand in AI, then search directly later (traffic misattributed as "branded search" instead of AI-influenced). Traditional analytics show organic branded traffic increasing but miss the AI touchpoint driving awareness. This attribution blindspot undervalues GEO ROI, creating budget allocation inefficiencies.

Example: User asks ChatGPT "best CRM for startups," sees your brand cited, doesn't click source link. Three days later, they Google your brand name directly and convert. Analytics attribute this to "branded organic" or "direct" traffic, missing that AI citation created awareness. Without proper attribution frameworks, GEO appears less effective than it actually is.

⚠️ Challenge 4: Market Awareness Gap

80% of companies don't track AI mentions of their brand, reflecting leadership's limited understanding of AI search importance and budget allocation lagging opportunity. Decision-makers trained on traditional SEO KPIs (rankings, traffic, backlinks) struggle conceptualizing citation-based success metrics. This awareness vacuum slows market adoption and creates friction for GEO service providers educating prospects.

"80% of companies don't track AI mentions of their brand"

(GEO Market Research Data)

❌ Traditional Agency Infrastructure Failures

Agencies offering GEO as add-on service lack infrastructure to solve these challenges. They don't have multi-platform tracking (most monitor only ChatGPT, ignoring Perplexity/Claude/Gemini where algorithms differ and your brand may be invisible). They cannot run controlled AEO experiments (test vs. control question groups) to prove causation between optimization changes and citation improvements.

These agencies provide surface-level audits without deep citation analysis: "You were mentioned 47 times this month" (but no context on competitive share of voice, no conversion attribution, no actionable roadmap for improving citations). Clients pay monthly retainers for reports showing vanity metrics, receiving reports not results. When leadership asks "How does this impact revenue?", agencies cannot answer because their measurement frameworks don't connect citations to pipeline.

🔬 The Expertise Vacuum

GEO requires understanding RAG (Retrieval-Augmented Generation) architecture (how AI platforms retrieve, rank, and cite sources when synthesizing answers). The divergence between platforms (35% citation overlap ChatGPT vs. Google, 70% Perplexity vs. Google, negative correlation for commercial queries) means separate optimization playbooks per platform.

Success demands earned media optimization (Reddit thread engagement, YouTube video seeding, review site presence engineering). This represents fundamentally different skill sets than traditional SEO: closer to PR/earned media + technical SEO + content strategy + data science. The market lacks practitioners with this hybrid expertise, creating talent shortages even as demand surges.

"GEO requires PR + technical SEO + content strategy + data science skills"

(Industry analysis of skill gaps)

✅ MaximusLabs' Proprietary Solution Framework

We solve these structural challenges through systematic infrastructure investments:

1. Multi-Platform Tracking Infrastructure: We establish baselines across ChatGPT, Perplexity, Gemini, Claude, and Google AI Overviews, measuring share of voice versus competitors and tracking citation frequency trends. Our unified dashboards provide apples-to-apples comparisons across platforms, revealing where you're visible and where you're losing to competitors.

2. Experimental Methodology: We run test/control groups for reproducible wins with statistical significance testing. Example: We tested whether schema markup improves AI citations across 100 queries (result was platform-dependent: helps Perplexity 23%, no measurable effect on ChatGPT). This rigor distinguishes proven tactics from industry speculation.

3. Platform-Agnostic Optimization: We build portable trust signals (authoritative citations in earned media, review platform dominance, structured data foundations) that transfer across platforms. When market consolidation occurs or new platforms emerge, our clients' trust assets migrate because they're not algorithm-specific hacks.

4. Educational Leadership: We pioneer AEO frameworks through public research, not follow commodity "best practices". Our Research-First Philosophy means we're discovering what works through controlled data, giving clients competitive advantages before tactics become mainstream.

🎯 The Research Intensity Advantage

Most "GEO best practices" circulating online are incorrect or unproven (only controlled experiments reveal truth). MaximusLabs runs systematic tests documented in thought leadership content, providing clients proven strategies versus industry speculation. This research intensity creates sustainable competitive advantage as the market matures and commoditizes (we're generating proprietary data that agencies copying surface tactics cannot replicate).

Q8. How Does GEO Differ from Traditional SEO? [toc=GEO vs SEO]

GEO isn't replacing SEO (it's a parallel optimization layer requiring fundamentally different strategies across ranking goals, content formats, success metrics, and technical approaches). Understanding these differences prevents the costly mistake most agencies make: treating GEO as "SEO + AI tracking tool".

📊 Comprehensive Technical Comparison: SEO vs. GEO

❌ The Traditional Agency Trap: SEO + Dashboard ≠ GEO

Most agencies treat GEO as "SEO + AI tracking tool" (they write the same narrative blogs, optimize with identical keyword tactics, build the same backlink profiles, then add a monitoring dashboard claiming "AI visibility"). This approach fails catastrophically because ChatGPT and Google run on different ranking signals with only 8-12% overlap in sources cited, and negative correlation (r ≈ -0.98) for commercial queries.

Sites highly cited by ChatGPT (editorial reviews, Reddit discussions, YouTube tutorials) are often ranked poorly by Google (which prioritizes brand pages and backlink authority). Conversely, sites ranking page 1 on Google may receive zero ChatGPT citations. Optimizing for one doesn't optimize for the other (these are fundamentally different games requiring different playbooks).

The consequence: agencies' clients rank page 1 on Google but remain invisible in AI results (invisible to 378 million GenAI users who never visit Google). When users ask ChatGPT for recommendations, these brands don't exist in the curated sample set, losing the buying conversation before it begins.

"ChatGPT and Google have 8-12% source overlap, negative correlation for commercial queries"

(Reddit GEO Market Analysis)

🔬 The Technical Divergence Deep-Dive

SEO Ranking Signals:

- Backlinks: Domain authority transfer from high-quality referring domains

- Dwell Time: User engagement signals (time on page, bounce rate)

- Keyword Optimization: Semantic relevance through term frequency and LSI keywords

- Technical Health: Site speed, mobile optimization, Core Web Vitals

GEO Ranking Signals:

- Citation Frequency in External Sources: How often authoritative third-party platforms (Reddit, YouTube, review sites) mention your brand with positive context

- Structured Data Clarity: Schema markup enabling RAG systems to parse, understand, and cite your content accurately

- E-E-A-T Signals (Especially Experience + Trustworthiness): First-hand expertise, author credentials, brand reputation across the web's 360-degree view

- UGC Presence: Genuine community discussions, not spam (Reddit threads, YouTube comments, Quora answers where users organically recommend your solution)

The "best website builder" example illustrates divergence perfectly: Wix ranks #1 on Google through strong backlinks and comprehensive content, but ChatGPT cites Webflow most frequently due to community discussions, review platform presence, and YouTube tutorial ecosystem. Completely different winners proving algorithmic independence.

✅ MaximusLabs' Integrated Parallel Approach

We execute parallel optimization (not force-fitting SEO tactics into GEO):

SEO Foundation (Google Optimization):

- Technical excellence (site speed, mobile optimization, indexation)

- Topical authority clustering (comprehensive category coverage)

- White-hat link building (authoritative backlinks from relevant domains)

GEO Layer (AI Platform Optimization):

- Citation Engineering Through Earned Media: Reddit community engagement with value-first contributions (not spam), YouTube demo seeding with micro-influencers, review platform optimization for G2/Capterra/TrustRadius with keyword-rich verified responses

- RAG-Friendly Content Structure: QA format with clear H2/H3 headings, bullet points for scannability, entity-rich schema markup (Organization, Product, FAQPage), comprehensive feature/integration details

- Multi-Platform Tracking: Unified measurement across ChatGPT, Perplexity, Gemini, Claude showing citation trends, share of voice, competitive positioning

Our Search Everywhere Optimization means clients win on Google AND ChatGPT AND Perplexity AND Claude, not just one channel. We don't retrofit square SEO pegs into round GEO holes (we architect strategies optimized per platform's unique ranking signals).

"Earned media comprises 70%+ of LLM citations"

(Market research on citation sources)

🎯 Practical Implementation Example: B2B SaaS Client

Traditional SEO Approach:

- Rank for "project management software" with 3000-word comparison blog

- Acquire backlinks from marketing blogs and software directories

- Internal linking from related product pages

- Result: Page 1 Google ranking, 2,000 monthly organic visits

MaximusLabs GEO Approach:

- Ensure brand appears when users ask ChatGPT: "What's the best project management tool for remote teams under 50 people with Jira integration?"

- Coordinated ecosystem execution:

- Reddit r/projectmanagement genuine community engagement answering questions (not spam)

- G2 review optimization (200+ reviews with keyword-rich responses mentioning specific features/integrations)

- YouTube demo seeding (partnering with 5-10 micro-influencers creating authentic tutorials)

- QA-formatted product pages with detailed schema markup for RAG ingestion

- Result: 35%+ citation rate in AI platforms, 6x higher conversion on AI-influenced traffic, branded direct traffic +120%

MaximusLabs orchestrates this entire earned media + owned property ecosystem, treating it as integrated campaign not siloed tactics. The comparison table shows these aren't incremental differences but paradigm shifts requiring different expertise, timelines, and investment structures.

Q9. What Investment and M&A Trends Are Shaping the GEO Market? [toc=Investment & M&A Trends]

The GEO market investment landscape reflects Silicon Valley's aggressive backing of AI search infrastructure, with venture capital pouring billions into platforms while service providers remain fragmented and undercapitalized. This funding asymmetry signals imminent consolidation: 60+ commodity tracking tools and hundreds of retrofit agencies face extinction as capital concentrates in proven winners.

💰 Venture Capital Activity: Platform Funding Dominance

Perplexity AI exemplifies explosive VC interest in AI search platforms: the company raised $1.5 billion total funding across multiple rounds since 2022, achieving a $20 billion valuation by September 2025 (up from $14 billion in early 2025). Key rounds include $500 million led by Accel at $14 billion valuation, $100 million extension at $18 billion valuation, and latest $200 million at $20 billion.

Perplexity's ARR trajectory demonstrates market traction: approaching $200 million ARR in Q3 2025 versus $150 million just weeks earlier. The company's aggressive moves (offering $34.5 billion for Google's Chrome browser and launching a $50 million venture fund for early-stage AI startups) position it as category consolidator.

In contrast, GEO-specific tools receive minimal funding: Writesonic raised only $3.1 million total across seed rounds ($2.6M from HOF Capital in September 2021, $125k pre-seed). This 500x funding gap between AI platforms ($1.5B Perplexity) and optimization tools ($3M Writesonic) reveals VCs bet on infrastructure, not implementation layers.

"Perplexity secured $200M at $20B valuation, ARR approaching $200M"

(TechCrunch September 2025)

📊 M&A Consolidation Predictions: 60+ Tools to 3-5 Winners

The tracking tool proliferation (60+ commodity products emerged in 2024-2025) creates classic consolidation setup. Historical parallels: SEO tool market consolidated from dozens to 3 dominant platforms (Semrush, Ahrefs, Moz); social media analytics collapsed into unified suites.

By 2027-2028, expect dramatic shake-out:

- 3-5 tracking platforms survive through superior data infrastructure, API partnerships with AI platforms, and enterprise sales teams

- Commodity tools acquired or shuttered as investors refuse follow-on funding without differentiation

- Traditional SEO platforms (Semrush, Ahrefs, HubSpot) integrate GEO features, crushing standalone point solutions through bundling

Global M&A activity supports this timeline: Q4 2024 delivered $1.3 trillion deal value, highest since 2021, with H1 2025 up 15% year-over-year despite 9% fewer deals (indicating larger strategic acquisitions over scattered small transactions). Technology sector leads with focus on AI, cybersecurity, and scalable infrastructure.

🏢 Strategic Acquisitions: Enterprise Tech Players Enter Market

Enterprise technology giants (Microsoft, Google, AWS) will acquire GEO capabilities rather than build to accelerate market entry. Analogous to cloud infrastructure M&A: AWS acquired Wickr for secure communications, Microsoft bought Nuance for healthcare AI, Google purchased Fitbit for health data.

Expected acquisition targets by buyer type:

Acquirer TypeTarget ProfileStrategic RationaleMicrosoft/Google/AWSGEO tracking platforms with API infrastructureIntegrate AI visibility analytics into Azure/GCP/AWS marketing suitesSemrush/Ahrefs/MozSpecialized GEO tools with multi-platform trackingBundle into existing SEO subscriptions, cross-sell to enterprise baseMarketing Clouds (HubSpot/Salesforce)GEO agencies with service methodology IPOffer managed services tier for enterprise accountsPrivate Equity FirmsRetrofit SEO agencies with client basesRoll up fragmented agencies, standardize GEO service delivery

Valuation multiples likely compress as commoditization accelerates (early exits 2025-2026 command premium multiples 8-12x ARR; late consolidation 2027-2028 sees distress sales at 2-4x ARR).

🚀 Startup Ecosystem Map: Early-Stage vs. Growth-Stage Divide

Early-Stage GEO Service Providers (pre-Series A, <$2M funding): Hundreds of boutique agencies launched 2023-2024, offering GEO audits and consulting without proprietary technology. Most lack capital for product development, sales teams, or thought leadership (vulnerable to consolidation).

Growth-Stage Platforms (Series A+, $5M+ funding): Fewer than 10 companies reached scale with VC backing for product roadmaps and go-to-market execution. These players survive consolidation through differentiated technology, brand recognition, or niche dominance.

💡 Investment Thesis: Why VCs Bet on GEO Infrastructure

Venture capital concentrates in platforms over services due to:

- Scalability: Software serves infinite customers with marginal cost near zero; agencies constrained by labor

- Network Effects: Platforms with more users generate better data; tracking tools improve as query volume increases

- Market Size: If 50%+ search shifts to AI by 2028 (Gartner), platform TAM reaches tens of billions; services remain fragmented

- Exit Multiples: Technology companies command 8-15x revenue exits; agencies trade at 1-3x revenue

✅ MaximusLabs' Capital-Efficient Positioning

MaximusLabs.ai operates capital-efficiently as specialized service provider, avoiding dilutive VC funding cycles while maintaining competitive advantages through proprietary research and methodology IP. Our scalable GEO content production systems and revenue-focused methodology create sustainable unit economics without platform build costs.

As consolidation eliminates undercapitalized agencies and commodity tools get acquired, we position as the AI-native partner with proven track record, avoiding both the fragility of early-stage startups and the corporate bureaucracy of acquired entities. Our focus remains client outcomes (becoming the answer AI engines cite), not fundraising narratives.

Q10. What Does the GEO Market Mean for Different Stakeholders? [toc=Stakeholder Implications]

The GEO market transformation creates distinct strategic imperatives for four stakeholder groups, each facing different timelines, investment requirements, and competitive dynamics. Understanding these persona-specific implications separates leaders from laggards in the AI search transition.

🚀 For B2B SaaS Founders: The First-Mover Advantage Window (2025-2027)

Competitive Moats Through Early AI Visibility: Companies starting GEO in Q4 2025/Q1 2026 will build 3-5 year compounding trust moats by 2028-2030 when mainstream competition intensifies and category leaders become unassailable. This mirrors SEO in 2008-2010 (early movers built domain authority that new entrants still cannot replicate).

Integration with Product-Led Growth: GEO amplifies PLG strategies by ensuring your product appears when high-intent users ask AI platforms detailed questions like "What's the best [category] for [specific use case] with [integration] under [budget]?" AI-referred traffic converts 6x higher than traditional search because users arrive educated and qualified.

Budget Allocation Recommendations: Allocate 15-25% of marketing spend to GEO in 2025-2026, scaling to 30-40% by 2028 as traffic shifts accelerate. For $500k annual marketing budget, this means $75k-125k to GEO (funding multi-platform tracking, earned media campaigns, content optimization, and strategic advisory).

"Companies starting GEO in 2025 will have 3-5 year trust moats by 2028"

(Reddit GEO Market Analysis)

📊 For VP Marketing / Head of Growth: Building GEO Capabilities

In-House vs. Agency Decision Framework:

Build In-House If: You have 10+ content marketers, dedicated SEO team, existing PR/earned media capabilities, engineering resources for technical implementation, and 12-18 month runway to develop expertise.

Partner with Agency If: You need immediate results (6-9 months), lack hybrid skill sets (PR + technical SEO + data science), want proven methodologies over experimentation, or require multi-platform tracking infrastructure.

Hybrid Model (Recommended): Agency partners for strategy + complex execution (Reddit engagement, review optimization, schema implementation) while in-house team handles content production and ongoing optimization.

Measurement Frameworks That Matter:

- Share of Voice: Your citation frequency vs. competitors for target queries across ChatGPT, Perplexity, Gemini

- Citation Rate: % of high-intent queries where your brand appears in AI-generated answers

- AI-Influenced Conversions: Branded direct + branded organic traffic increase correlating with AI visibility improvements (track with UTM parameters and attribution modeling)

- Competitive Positioning: Sentiment analysis of how AI describes your product vs. competitors

Executive-Level Reporting:

Translate AI visibility into business metrics leadership understands: "35% increase in share of voice for [category] queries correlates with 28% lift in branded search and $450k incremental pipeline". Avoid vanity metrics ("mentioned 342 times") without conversion context.

Cross-Functional Requirements:

GEO demands coordination across Content (QA-formatted pages with schema), PR (earned media outreach to Reddit/YouTube/review sites), Product (ensuring feature documentation supports AI parsing), and Engineering (technical implementation of structured data).

⚠️ For Traditional Marketing Agencies: Adapt-or-Die Urgency

Existential Threat: As 50%+ of search traffic moves to AI platforms by 2028 (Gartner forecast), clients will demand omnichannel visibility. Agencies stuck in Google-only optimization face client churn to AI-native competitors like MaximusLabs.

Skill Gap Closure Requirements: Hire or train for hybrid expertise (PR/earned media specialists, data scientists for RAG optimization, technical SEO engineers understanding schema markup, and multi-platform tracking analysts). The market lacks practitioners with these combined skills, creating talent competition.

Service Model Evolution: Shift from pure retainer (delivering monthly hours) to retainer + performance hybrid (base fee + bonuses tied to share of voice improvements, citation rate increases). Clients increasingly demand outcome guarantees, not activity reports.

Competitive Threats: AI-native agencies enter with proven GEO methodologies, research-backed strategies, and proprietary tracking infrastructure. Traditional agencies' 10-year SEO client relationships won't prevent churn if clients become invisible in AI search.

"Traditional agencies face obsolescence as 50%+ search shifts to AI by 2028"

(Market consolidation analysis)

🏢 For Enterprise Decision-Makers: Risk Assessment & Vendor Evaluation

Risk of Inaction:

Becoming invisible to 378 million GenAI users who never visit Google means losing entire cohorts of buyers. When users ask AI platforms for recommendations and your brand doesn't appear in the curated sample set, you're excluded from buying conversations before they begin.

Quantified Impact: If 25% of your target audience shifts to AI search by 2027 and you're absent from AI results, that's 25% pipeline loss (e.g., $2M ARR company loses $500k annually). 80% of companies don't track AI mentions, meaning most decision-makers don't realize they're invisible.

RFP Considerations When Evaluating GEO Vendors:

Evaluation CriteriaWhat to Look ForRed Flags Indicating Failure RiskAI-Native vs. RetrofittedProprietary research, documented experiments, methodology IPGeneric "best practices," no original dataMulti-Platform CoverageUnified tracking ChatGPT + Perplexity + Gemini + Claude + Google AISingle-platform focus (ChatGPT only)Earned Media CapabilitiesReddit engagement portfolio, YouTube partnerships, review optimizationWebsite-only optimization, no UGC presenceMeasurement MaturityShare of voice tracking, test/control experiments, conversion attributionMention counting without business contextStrategic DepthRevenue goal alignment, pipeline focus, ICP-specific contentVanity metrics obsession (impressions, mentions)

Integration with Existing Martech Stack: GEO requires connections to Google Analytics (conversion tracking), CRM (pipeline attribution), content management systems (schema implementation), and PR tools (media monitoring). Vendors should document integration requirements upfront.

ROI Expectations & Timeline: Realistic GEO delivers 20-35% citation rate improvements within 6-12 months, translating to 15-25% branded search lift and 10-18% incremental pipeline for B2B SaaS. Promises of "instant results" signal inexperience; trust building requires sustained effort.

💡 MaximusLabs Simplifies Stakeholder Complexity

MaximusLabs.ai serves all four stakeholder groups with tailored approaches: SaaS Founders get first-mover advantage through rapid deployment; VP Marketing/Growth receive executive-ready dashboards and cross-functional playbooks; Agencies access white-label GEO capabilities; Enterprises benefit from proven vendor evaluation frameworks. Our cost-effective GEO partnership model and scalable content production systems deliver outcomes without the overhead of building in-house capabilities from scratch.

Q11. What Does the Future Hold for the GEO Market? [toc=Future Market Evolution]

The GEO market will undergo dramatic transformation by 2030, evolving through three distinct phases that separate early movers building defensible moats from late adopters facing insurmountable competitive disadvantages. Understanding this trajectory enables strategic positioning before consolidation and commoditization eliminate first-mover advantages.

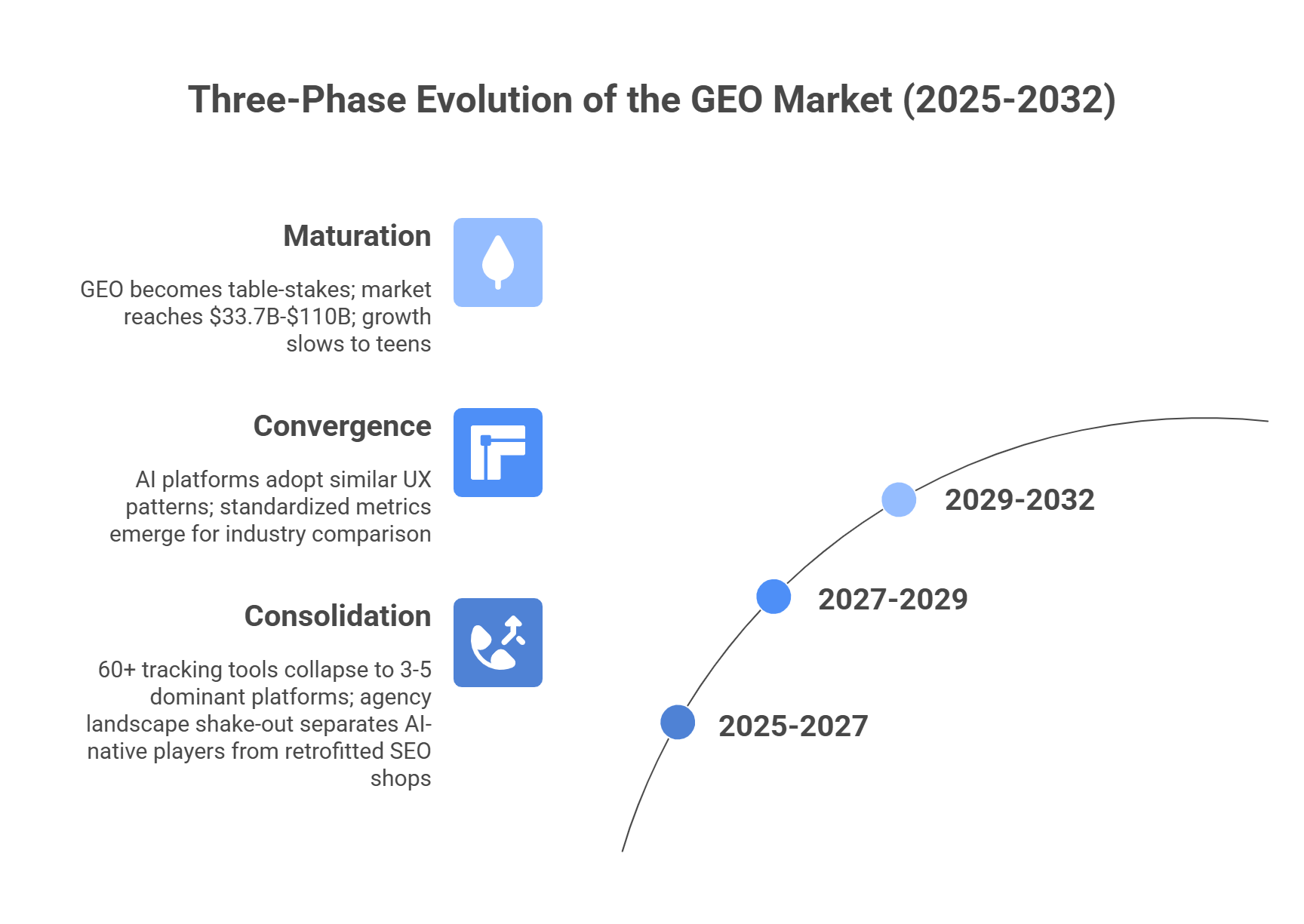

📅 Three-Phase Market Evolution (2025-2032)

Phase 1: Consolidation (2025-2027)

60+ tracking tools collapse to 3-5 dominant platforms through M&A, market exits, and investor-forced shutdowns. Traditional SEO platforms (Semrush, Ahrefs, HubSpot) integrate GEO features, bundling AI visibility tracking into existing subscriptions (crushing standalone point solutions unable to compete on pricing or distribution).

Agency landscape shake-out separates AI-native players from retrofitted SEO shops: agencies treating GEO as "SEO + AI dashboard" lose clients to specialized competitors when algorithmic divergence becomes undeniable (8-12% source overlap between ChatGPT and Google decreases further as platforms differentiate). Hundreds of boutique agencies launched 2023-2024 exit the market as capital dries up and client acquisition costs exceed lifetime value.

Phase 2: Convergence (2027-2029)

AI platforms adopt similar UX patterns but maintain distinct algorithms (analogous to Google/Bing today with similar interfaces producing different results). Users expect consistent conversational search experiences across ChatGPT, Perplexity, Gemini, Claude, but ranking signals remain platform-specific, requiring nuanced optimization strategies.

Standardized metrics emerge as industry associations and leading platforms establish benchmarks: share of voice calculations, citation rate definitions, attribution methodologies. This standardization enables vendor comparison but eliminates differentiation through proprietary measurement (shifting competition to execution quality).

Phase 3: Maturation (2029-2032)

GEO becomes table-stakes like SEO today (expected minimum competency for digital presence). Late adopters face insurmountable disadvantages: early movers accumulated 3-5 years of trust signals (authoritative citations, review dominance, community influence) that new entrants cannot replicate with budget alone.

Market reaches projected $33.7B-$110B depending on TAM definition (services-only vs. full ecosystem including platforms). Growth rate slows from 50%+ CAGR to teens as penetration saturates, signaling transition from growth to mature market.

❌ Traditional Agency Extinction Risk

Agencies refusing evolution beyond Google-only optimization face obsolescence as 50%+ of search traffic moves to AI platforms by 2028 (Gartner forecast). Clients will demand omnichannel visibility with unified measurement (the retrofit approach adding AI tracking to 2015-era SEO playbooks fails as divergence becomes clearer).

Client churn accelerates when agencies deliver reports showing "Google position #3" while brands remain invisible in ChatGPT/Perplexity results frequented by 378 million GenAI users. Market consolidation forces commodity players out, leaving specialized AI-native experts like MaximusLabs and full-service martech platforms absorbing mid-market through bundling.

"Agencies treating GEO as 'SEO + AI dashboard' will fail catastrophically"

(Market evolution analysis)

🏆 The Trust Compounding Advantage

Unlike traditional SEO where algorithm updates reset rankings overnight (Penguin penalties destroyed businesses, Panda updates erased traffic), GEO success builds durable competitive moats through trust accumulation:

- Authoritative Citations in Earned Media: 6-month old Reddit threads continue generating AI citations; 2-year old YouTube reviews compound authority

- Review Platform Dominance: G2/Capterra presence with 200+ verified reviews creates citability threshold competitors take years to match

- Community Influence Leadership: Genuine value contributions in subreddits, forums, Quora establish thought leadership AI platforms recognize

- Structured Data Foundations: Schema markup with entity relationships creates RAG-friendly architecture surviving platform changes

These assets compound over time, creating sustainable competitive advantages that survive AI platform disruptions. When ChatGPT gets disrupted by next-generation AI (as Google disrupted Yahoo), trust signals migrate because they're platform-independent (residing in the web's collective knowledge graph, not algorithm-specific hacks).

✅ MaximusLabs Future-Ready Positioning

Our strategy prepares clients for all convergence scenarios (we optimize for top 3 current platforms - ChatGPT 60% usage share, Google AI Overviews, Perplexity - while building platform-agnostic trust signals that transfer across any AI architecture).

Why Our Approach Survives Platform Changes:

Focus on E-E-A-T (Experience + Trustworthiness): We prioritize genuine expertise demonstration and earned reputation over algorithmic gaming. AI platforms evolving ranking algorithms still weight trustworthy sources (the specific signals change but the underlying principle remains).

Citation Engineering Through Earned Media: 70%+ of LLM citations come from earned media (Reddit, YouTube, review sites, not owned properties). Our Search Everywhere Optimization builds presence in authoritative third-party sources AI platforms index regardless of which specific platform dominates.

Research-Proven Methodologies: When consolidation eliminates weak agencies, MaximusLabs' proprietary experimental data (1000+ query variations tested, documented wins, statistical significance validation) positions us as Category King in AI-native optimization.

🎯 Actionable Forecast: The Closing Window

Companies starting GEO in Q4 2025/Q1 2026 will have 3-5 year compounding trust moats by 2028-2030 when competition intensifies and leaders become unassailable. This parallels SEO in 2008-2010 (early movers built domain authority through years of consistent effort that new entrants with larger budgets still cannot match in 2025).

The market window closes as awareness spreads from current 20% who track AI to 80%+ by 2028. First-mover advantage exists only while 80% remain blind to AI visibility gaps (once mainstream understands importance, competition for citation share intensifies exponentially, driving costs up and ROI down).

MaximusLabs offers first-mover advantage through proprietary data, proven methodologies, and AI-native teams (not retrofitted SEO practitioners). Partner with us to become a Category King in your niche (the trusted source AI engines cite when answering the world's most important questions in your domain). The compounding trust moat you build in 2025-2027 determines whether you lead or follow in 2028-2032.

"Early movers build trust moats that late adopters can't replicate with budget"

(Strategic market timing analysis)

Q12. How Should Your Company Approach GEO Market Entry? [toc=GEO Market Entry]

Entering the GEO market successfully requires strategic decisions across five dimensions, with most companies underestimating the complexity (GEO isn't a single tactic but orchestrated ecosystem coordination). Understanding common failure patterns and evaluation frameworks separates wasted budget experiments from revenue-generating implementations.

🎯 Five Strategic Entry Decisions

1. In-House vs. Agency vs. Hybrid Model: In-house requires 10+ person team with hybrid skills (PR, technical SEO, data science); agency provides proven methodologies immediately; hybrid optimal for most (strategy from experts, execution scaled internally).

2. Platform Prioritization: Target ChatGPT (60% usage), Google AI Overviews (established user base), and Perplexity (fastest-growing) initially; expand to Gemini and Claude once foundations established.

3. Budget Allocation: Allocate 15-25% of marketing spend to GEO in entry phase; underfunding (<10%) produces no results, creating false "GEO doesn't work" narrative.

4. Success Metrics Definition: Track leading indicators (share of voice, citation rate) and lagging indicators (AI-influenced conversions, pipeline); most agencies provide only vanity metrics (mention counts).

5. Organizational Readiness: Secure executive sponsorship, cross-functional commitment (content, PR, product, engineering), and 6-12 month timeline acceptance (GEO requires trust building, not instant optimization).

❌ Five Common Entry Mistakes That Burn Budget

Mistake 1: Treating GEO as SEO Extension: Hiring traditional SEO agency expecting same tactics to work (fails because ChatGPT and Google have only 8-12% source overlap with negative correlation for commercial queries). Sites ranking page 1 Google often receive zero ChatGPT citations, proving these are different games.

Mistake 2: Tool-First Approach: Buying tracking dashboard expecting insights to drive themselves without strategy (tools answer "how many mentions?" but provide no roadmap for improving citations or converting visibility to revenue).

Mistake 3: Underinvestment: Allocating 5% of budget expecting 50% of results (GEO requires earned media campaigns - Reddit engagement, YouTube partnerships, review optimization - content restructuring, technical implementation). Insufficient investment produces no measurable outcomes.

Mistake 4: Impatience: Expecting 30-day results when trust building requires 6-12 months (authoritative citations accumulate gradually as AI platforms index new content, reviews, community discussions). Early-stage experiments fail before compounding begins.

Mistake 5: Single-Platform Focus: Optimizing only for ChatGPT, missing Perplexity/Gemini where algorithms differ (35% citation overlap between ChatGPT and Google, 70% between Perplexity and Google means platform-specific strategies required).

"Most companies underestimate GEO complexity—it's ecosystem orchestration, not single tactic"

(Strategic entry analysis)

✅ Partner Selection Framework: 5 Critical Assessment Dimensions

DimensionWhat Excellence Looks LikeRed Flags Indicating Failure Risk1. AI-Native vs. RetrofittedProprietary research, documented experiments (e.g., "tested schema across 100 queries"), methodology IP, thought leadershipGeneric "best practices," no original data, copied content from AI blogs, launched 2024 with no track record2. Multi-Platform CoverageUnified tracking ChatGPT + Perplexity + Gemini + Claude + Google AI Overviews, platform-specific strategiesChatGPT-only focus, claims "all platforms work the same," single dashboard without nuanced optimization3. Earned Media CapabilitiesReddit engagement portfolio (real threads, not spam), YouTube partnerships, G2/Capterra optimization, PR networkWebsite-only optimization, no UGC presence, "we'll write blog posts for you," ignores 70% citation sources4. Measurement MaturityShare of voice vs competitors, test/control experiments, conversion attribution, exec dashboardsMention counting ("you were cited 47 times"), no competitive context, no business impact analysis5. Strategic DepthRevenue goal alignment, pipeline focus, ICP-specific queries, BOFU/MOFU contentVanity metrics obsession (impressions, traffic), TOFU content volume, generic recommendations

Most "GEO agencies" fail 3+ of these criteria (they're traditional SEO shops adding "GEO" to service menus without fundamental capability transformation).

🚀 MaximusLabs' Proven 4-Phase Implementation Methodology

Phase 1: Baseline & Audit (Weeks 1-4)

Establish current AI visibility across all platforms: ChatGPT, Perplexity, Gemini, Claude, Google AI Overviews. Conduct competitive share of voice analysis for target queries, citation source mapping (where do competitors get cited from?), and technical foundation assessment (schema markup, structured data readiness).

Phase 2: Strategic Foundation (Weeks 5-8)

Identify highest-ROI query targets through search behavior analysis (which 10-15 word conversational queries drive pipeline in your category?). Complete content gap assessment (what do AI platforms need that you don't provide?), earned media opportunity identification (which Reddit communities, YouTube channels, review platforms matter?).

Phase 3: Systematic Execution (Months 3-9)

Develop QA content with RAG optimization (clear headings, bullet points, schema markup for AI parsing). Launch earned media engagement campaigns: Reddit value-first contributions (not spam), YouTube demo seeding with micro-influencers, review platform optimization (G2/Capterra with keyword-rich verified responses). Implement test/control experimentation to validate what actually works versus industry speculation.

Phase 4: Measurement & Optimization (Months 10-12+)

Provide unified dashboard tracking all platforms, showing citation trends, share of voice improvements, competitive positioning shifts. Attribute conversions to AI-influenced touchpoints (branded direct traffic correlating with visibility increases), deliver monthly strategic reviews with exec-level reporting connecting AI metrics to pipeline impact.

Our Trust-First + Revenue-Focused methodology ensures clients build sustainable moats while driving pipeline, not just vanity mentions.

⚠️ Entry Readiness Decision Framework

You're ready for GEO investment if:

- 6-12 month timeline acceptance ✅

- $10k+ monthly budget ($120k+ annually) ✅

- Executive buy-in and cross-functional coordination ✅

- Recognition AI search is strategic priority, not experiment ✅

Wait if:

- Seeking 30-day wins ❌

- "Testing" with $2k budget ❌

- No executive sponsorship ❌

- Treating as tactical SEO add-on ❌

Underfunded GEO produces zero results and creates damaging false narrative that "GEO doesn't work for our business" (when reality is insufficient investment prevented any meaningful execution).

💼 MaximusLabs Partnership Approach

MaximusLabs works with companies serious about becoming Category Kings in their space. We turn down clients seeking vanity metrics or quick hacks (we optimize for long-term partnerships, not short-term sales).

Ideal client profile: VP Marketing/Head of Growth at growth-stage B2B SaaS company, or Founder at venture-backed startup ready to dominate AI search in your category. If you have 6-12 month timeline, appropriate budget ($10k+ monthly), and recognize AI visibility as strategic priority, book a strategic consultation.

We'll assess if you're positioned to win, provide honest evaluation (including whether we're the right fit or if you should wait/build in-house), and outline customized roadmap. If MaximusLabs isn't optimal for your situation, we'll tell you directly (our reputation depends on client success, not forcing-fit partnerships destined to fail).

Stop optimizing for Google. Start optimizing for trust. The compounding moat you build in 2025-2027 determines whether you lead or follow in 2028-2032.

"Companies with 6-12 month timeline, $10k+ monthly budget, executive buy-in ready for GEO"

(Entry readiness framework)

.png)

.png)